Transactions

Clearview Realty Finance has advised clients across a broad spectrum of commercial and apartment real estate debt, equity, acquisition and disposition transactions. With over a century of capital markets experience, the team has completed financings that reflect a considerable range in size, structure and geographic location. The portfolio of the selected representative transactions closed by CRF principals demonstrates this diversification.

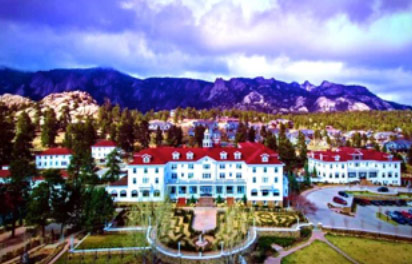

Four Diamond Resort & Spa – 10 Year Fixed Refinance

$200,000,000

CO, Historic Hotel Resort & Spa – Renovation/New Construction Loan

$73,750,000

Nashville, TN – Flagged Hotel – Cash Out – IO Structured Bridge Financing

$113,000,000

Cold Storage Industrial / Distribution – Fixed Rate Refinance

$19,200,000

Bakersfield, CA – Con. Center Hotel

Cash Out Refinance with PIP Funding

$24,700,000

Western US – Downtown Class B Office Fixed Rate – Cash Out Refinance

$22,000,000

Big Box Power Retail Center – Long Term Permanent Financing

$27,500,000

Southern CA, Apartment Complex –

10 Year Fixed Rate Agency Refinance

$17,000,000

AL, MS, TN, IL, TX Retail Center Portfolio Low Leverage Recap.

$26,500,000

AZ – Class B Apt Complex -3 Yr IO Bridge Financing with Earn-Out

$35,000,000

Apartment/Office/Retail Portfolio – Value Add Bridge Financing

$16,250,000

Boston Infill Office Portfolio – Acquisition Financing With CapEx

$32,000,000

Central TX Regional Retail Center –

High Leverage Refinance

$23,000,000

Western US Class B Apartment Homes High Leverage IO Acquisition Financing

$22,800,000

Coastal Community Retail Center – Construction and Take-Out Financing $11,300,000

Suburban Regional Retail Center –

Construction to Permanent Financing $34,000,000

Northern CA Anchored Retail- Floating Rate Bridge Refinance

$13,600,000

Los Angeles, CA – Infill Entitled Land

Quick Close – Cash Out Refinance

$9,300,000

Class A Multifamily – Long Term

Fixed Rate Financing

$26,000,000

La Jolla, CA– Class A Suburban Office

10 Yr Fixed Cash Out Refinance

$6,200,000

Laguna Hills, CA – Mobile Home Park

7 Year Fixed Rate Refinance

$5,100,000

Suburban Office Park – Floating Rate Bridge Loan

$103,500,000

Western US – Industrial / Office Off Market Sale-Leaseback Financing

$54,000,000

Fort Worth / Dallas TX Apartment Portfolio – Off Market Acquisition

$66,000,000

Denver, CO – Class A Apartments

IO Bridge Financing With Earn-Out

$34,000,000

Nashville, TN – Hotel & Restaurant

Cash Out – IO Bridge Refinance

$47,000,000

Southern CA – Class B Apartments

Low Leverage – Cash Out Refinance

$22,500,000

Southern CA – Power Retail / Theatre – Cash Out Perm Financing

$37,000,000

Metro Urban Loft Apartments – Private Capital Repositioning

$14,950,000

Nashville, TN Adaptive Reuse – Construction / Bridge Financing

$36,200,000

Suburban Power Retail Center – Life Company Refinance

$30,250,000

Central US – Class A Apartments

Off Market Disposition Advisory

$31,300,000

Atlanta, GA Garden Style Apartments

High-Leverage IO Bridge Financing

$28,325,000

Class A Suburban Office Park – Long Term Fixed Rate Refinance

$24,500,000

Suburban Medical Office Portfolio –

Fixed Rate Refinance

$14,300,000

Southern CA– Class B Medical Office

10 Year Fixed – Life Co. Refinance

$8,550,000

Northern CA Medical Office Park –

10 Year Fixed Refinance

$12,800,000

Midwest Corp Headquarters –

20 Year Fixed Perm Financing

$46,250,000

Upstate NY – Class A Senior Apartments

Non-Recourse Construction Completion

$19,500,0000

Western US – Class B Apt Complex

10 Year IO – Cash Out Refinance

$10,300,000

Western US Retail Center – Off Market

Pension Fund Disposition

$28,000,000

Senior Mobile Home Community –

10 Year Fixed Refinance

$9,000,000

Convention Center Hotel – Balance Sheet Refinance with Mezz Option

$141,000,000

Best in Class Coastal Resort – Non-Recourse Construction Financing

$150,000,000

Coastal Hotel & Resort – Hybrid Structure CMBS Financing

$45,000,000

Dallas TX Class A Apartment– Acquisition Financing with Mezzanine

$33,500,000

Western US – Mobile Home Park 10 Year Fixed Rate Cash Out Refinance

$34,900,000

DTLA – Metro Live / Work Loft Apts

3 Yr IO – Cash Out Bridge Refinance

$27,500,000

National Apartment Developer – Unsecured Line Of Credit

$18,000,000

Western US Single Tenant Retail – High Leverage Acquisition

$6,100,000

Winnipeg, Canada Industrial / Office

10 Year Fixed Rate Refinance

$26,200,000

Southern CA Hotel – Structured Refinance with Mezzanine

$33,000,000

Metro Boutique Office – Floating Rate Bridge Financing

$11,250,000

National Net Leased Walgreens

Portfolio – Acquisition Financing

$24,200,0000

Atlanta, GA Boutique Office Park – Pension Fund Refinancing

$12,500,000

Pacific NW Flagged Airport Hotel – Cash-Out Credit Union Refinance

$13,300,000

Western US – Shopping Center –10 Yr Fixed Rate Refinance with Cash-Out

$12,500,000

Yucca Valley, CA – Mobile Home Park Off Market Acquisition / Financing

$8,000,000

Southern CA – Self Storage Facility

10 Year IO – Cash Out Refinance

$7,250,000

Sacramento, CA – Medical Office Park

10 Yr IO – Cash Out Bridge Refinance

$9,500,0000

Western US – Boutique Inn & Resort

Fixed Rate Interest Only Refinance

$18,000,000

New Construction Flagged Hotel – Pre-Stabilization Perm Financing

$28,000,000